One of the central bank’s roles is to manage a country’s international reserves. But, central bank reserve managers have been losing sleep over two main issues: low interest rates, and how best to communicate the choices they make.

Central banks’ reserve managers decide on how to invest central banks’ international reserves, what to invest in, and when. The overarching investment objective is to help preserve the external value of the domestic currency. They base this objective on three main pillars: preserving the capital of the investments, ensuring the liquidity of assets—how tradable they are—and earning a return.

Even though many countries’ economies are recovering after the global financial crisis, many reserve managers are still fretting. We wanted to know why. So we asked 63 central banks from advanced, emerging, and low-income countries about the reasons behind their worries. Their answers revealed a lot and were quite similar. We pulled together the results and here are the top two things reserve managers worry about.

Low interest rates

Low interest rates are their main concern, as you can see in the figure below. Returns on central banks’ international reserves are low, and in some cases even turned negative. Reserve managers are struggling to find sources of income without taking unacceptable risks. Before the global financial crisis, even safe and liquid assets—such as government bonds—enabled generally good returns, and the three pillars underlying the investment objective could be relatively easily achieved. This is no longer the case.

Reserve managers have had to find new solutions, but face higher risks if they want to increase returns. Some of them have tried to invest in currencies that will give them a higher rate of return on their investment, but with the increase in the volatility of foreign exchange markets, they have swapped one concern for another—lower returns for currency risk. The choices are difficult: what risks to take, how, and whether the newly employed solutions will deliver the desired results. For example, investing in emerging market or corporate bonds may bring in more money in the short run, but may not provide a steady stream of investment income.

Communicating choices

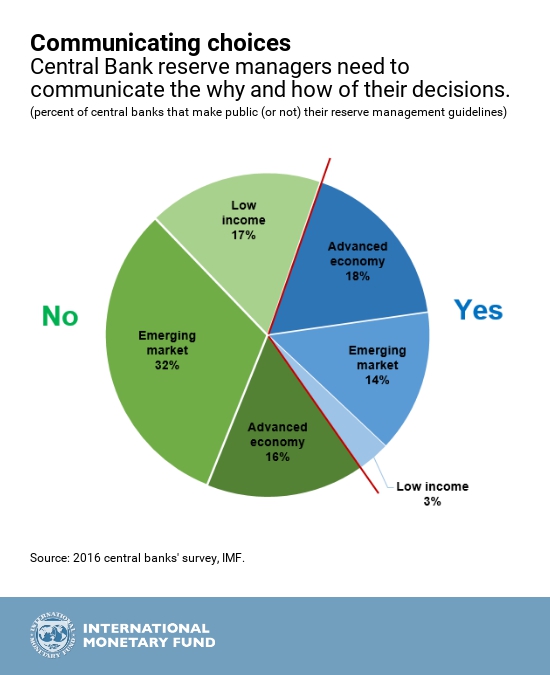

Asset managers have started to communicate their choices more, but it remains hard for many central banks to convey the choices they make, and why. The chart below shows the majority of central banks we surveyed do not publish their reserve management guidelines. Clear and consistent communication about reserve management practices and choices helps financial markets and the public understand why reserve managers make the choices they do. This means explaining that managing international reserves is not about making a profit. Ultimately, it is about preserving the external value of the domestic currency and putting stability first.

So how do reserve managers strike a balance? Most of them focused on the first two pillars—capital preservation and a high level of liquidity of their reserves—at the expense of the return on their investments. Central banks’ stakeholders should support this strategy, especially in times of increased financial volatility and low interest rates.